Looking for the best trading platform? Here's a quick comparison:

- MotiveWave: Ideal for advanced technical traders. It offers 275+ built-in studies, tools like Elliott Wave, Hurst Cycles, and Gann Analysis, multi-monitor support, and custom strategy creation with a Java SDK. Pricing starts at $24/month or $245 for a one-time purchase (Standard edition).

- TradingView: Perfect for beginners and social traders. It’s web-based, has a community of 100M+ users, supports mobile trading, and features 10M+ user-created scripts. Free plans are available, with premium plans starting at $14.95/month.

Quick Comparison

| Feature | MotiveWave | TradingView |

|---|---|---|

| Platform Type | Desktop (Windows/macOS/Linux) | Web-based + Mobile |

| Core Strength | Advanced Technical Analysis | Social Trading & Accessibility |

| User Base | 100,000+ | 100M+ |

| Custom Tools | Java SDK for strategies | Community-driven scripts |

| Pricing | Starts at $24/month | Starts at $14.95/month |

Choose MotiveWave if you need advanced tools for in-depth analysis and strategy creation.

Choose TradingView if you’re a beginner or prefer a collaborative, mobile-friendly platform.

Platform Features

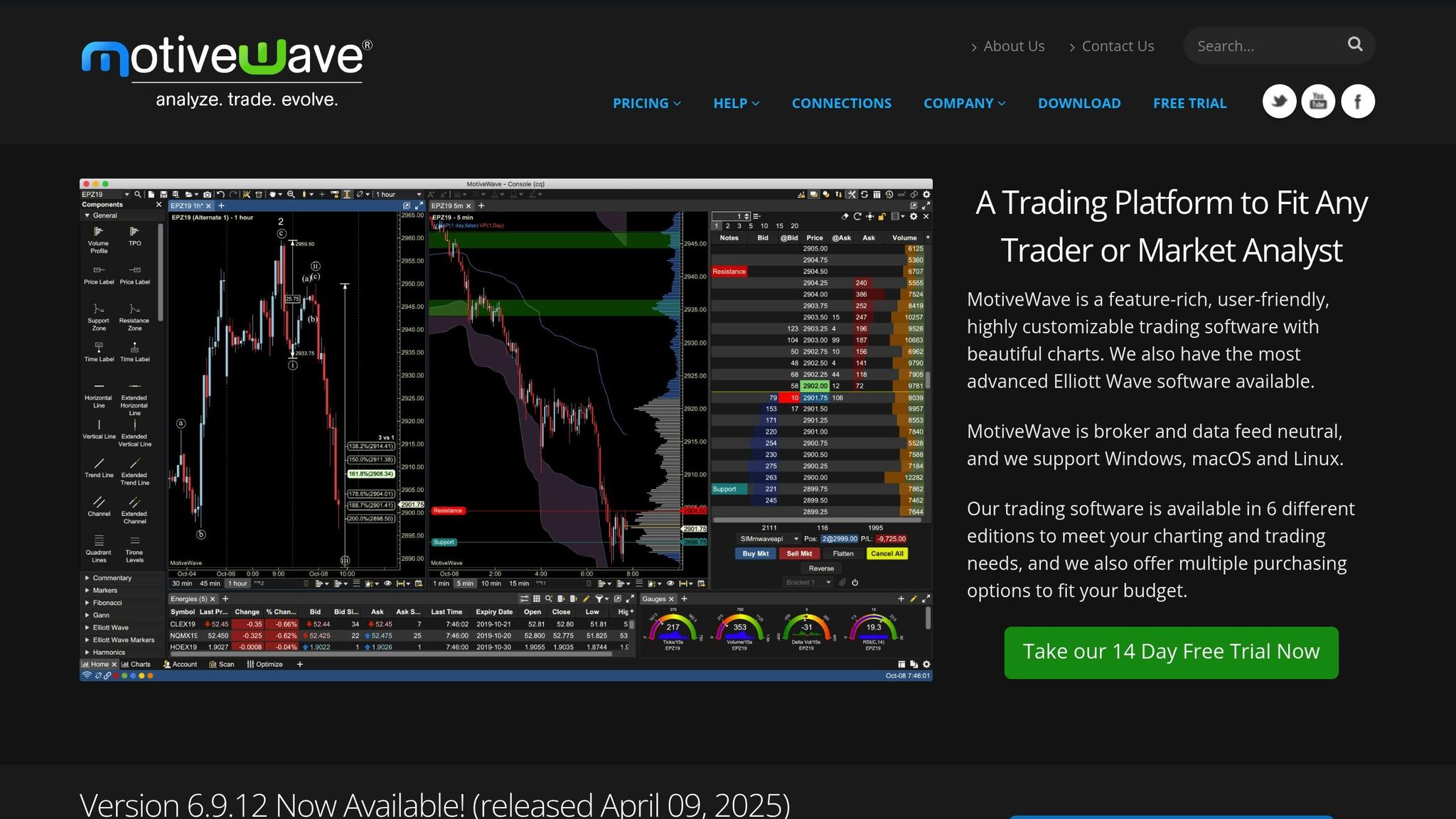

MotiveWave: Advanced Tools for Technical Traders

MotiveWave stands out with its extensive technical analysis capabilities, offering over 275 built-in studies. These include specialized tools for Elliott Wave, Hurst Cycles, and Gann Analysis. The platform also supports strategy development through a Java SDK, allowing traders to create custom studies and automated trading strategies. It even provides comprehensive backtesting options across multiple brokers.

"MotiveWave is a game changer. For today's advanced technical trader looking to analyze and interpret massive amounts of market data look no further than the industry leader." - Todd Gordon, CEO & Founder - TradingAnalysis.com

Another highlight is its multi-monitor support, featuring a 'Tile Windows' function for creating detailed workspace layouts. Plus, the advanced alerting system ensures traders stay updated on price changes and study conditions with notifications sent directly to their smartphones.

TradingView: Social Trading in Your Browser

Unlike MotiveWave's desktop-centric approach, TradingView is designed for the web, prioritizing accessibility and social trading. With a community of over 100 million traders and investors, the platform encourages collaboration. Users have created more than 10 million custom scripts, and its mobile app boasts a stellar 4.9 rating from 1.5 million reviews.

| Feature Comparison | MotiveWave | TradingView |

|---|---|---|

| Platform Type | Desktop-based (Windows, macOS, Linux) | Web-based |

| Core Strength | Advanced Technical Analysis | Social Trading & Accessibility |

| User Base | 100,000+ registered users | 100M+ traders and investors |

| Custom Tools | Java SDK for custom studies and strategies | Community-driven scripts and ideas |

| Market Coverage | Access to 30+ brokers and data services | Broad market summaries |

TradingView also provides detailed market summaries for major indices like the S&P 500, Nasdaq 100, and Dow 30, making it a go-to for traders needing a quick overview. Its emphasis on community has earned it the title of the #1 ranked website globally for investing.

While MotiveWave caters to traders seeking depth and customization, TradingView thrives on its community-driven design and broad market insights. Both platforms serve different needs, making them valuable in their own ways.

Price Comparison

Subscription Plans and Fees

MotiveWave offers several pricing options, including subscriptions (leases) and one-time purchases, catering to a wide range of users. There are six editions available, starting with a free Community edition for basic charting.

| Edition | Monthly Lease | One-Time Purchase | Annual Support* |

|---|---|---|---|

| Community | Free | N/A | N/A |

| Standard | $24 | $245 | $55 |

| Order Flow | $49 | $595 | $105 |

| Elliott Wave Lite | $89 | $1,395 | $205 |

| Professional | $99 | $1,495 | $225 |

| Ultimate | $159 | $2,295 | $295 |

*Annual support fees apply after the first year for purchased licenses.

For users seeking shorter-term commitments, MotiveWave also provides 3-month and 6-month lease options for its premium editions:

- Elliott Wave Lite: $250 (3-month), $475 (6-month)

- Professional: $295 (3-month), $565 (6-month)

- Ultimate: $455 (3-month), $875 (6-month)

Cost Analysis

Here’s a breakdown of long-term costs for leasing versus purchasing:

Monthly Lease Costs Over Time (based on the Professional edition at $99/month):

- 1 year: $1,188 ($99 × 12)

- 2 years: $2,376 ($99 × 24)

- 3 years: $3,564 ($99 × 36)

One-Time Purchase Costs Over Time (Professional edition at $1,495):

- 1 year: $1,495 (initial purchase)

- 2 years: $1,720 ($1,495 + $225 for support renewal)

- 3 years: $1,945 ($1,495 + $225 × 2)

Key points to consider:

- One-time purchases include one year of updates and support.

- After 15–18 months, buying outright typically becomes more economical for long-term users.

- Data feeds are not included, so users need to connect to supported brokers or data providers.

- A single license can be installed on multiple computers but is limited to use on one device at a time.

These pricing details can help traders choose the best option based on their trading style and budget.

Platform Experience

Interface and Learning Curve

MotiveWave's desktop interface blends professional tools with user-friendly design. The platform's console is designed to keep everything organized - charts, analysis tools, watch lists, trading utilities, and custom workspace layouts all have their place. Its 'Tile Windows' feature makes it easy to arrange charts and tools across multiple screens, perfect for traders keeping tabs on several markets at once.

To help users get started, MotiveWave provides several resources:

- A detailed user guide

- A 14-day free trial with access to all features

- An active user forum for community support and trading discussions

Personal Settings and Social Features

The platform goes beyond a simple interface by offering extensive customization options, allowing traders to tailor their environment to their preferences. Here's a quick look at some of the key customization features:

| Customization Category | Options Available |

|---|---|

| Chart Customization | • Custom bar sizes and types • Over 275 built-in studies • Flexible panel arrangements |

| Workspace Organization | • Stackable layouts • Adjustable console layout |

| Analysis Tools | • Alternate analyses • Custom instrument combinations • Quick bar size selector |

MotiveWave also offers theme customization to reduce eye strain during extended trading sessions. Advanced users can create custom instruments by combining historical and live data from multiple assets. Additionally, the platform supports alternate analyses, letting users test different strategies without altering their primary chart setup.

This flexibility is available across Windows, macOS, and Linux, ensuring a consistent experience no matter which operating system you use.

sbb-itb-2e26d5a

User Type Analysis

Advanced Traders

MotiveWave is tailored for professional traders who require in-depth technical analysis tools. It provides a wide array of features designed to handle complex trading strategies:

| Analysis Tools | Details |

|---|---|

| Technical Studies | - Hundreds of pre-built studies and strategies - Advanced Fibonacci tools - Customizable bar sizes |

| Broker Integration | - Compatibility with over 30 brokers - Advanced order management features - Real-time scanning tools |

| Strategy Tools | - Automated trading systems - Backtesting capabilities |

On the other hand, TradingView targets beginners, focusing on ease of use and fostering a community-driven learning experience.

New Traders

TradingView is an excellent starting point for those new to trading. With a community of over 100 million active traders and investors, it offers a collaborative environment where beginners can learn and grow. The free plan provides access to essential features, making it easier for newcomers to build confidence in their trading skills.

Key features for beginners include:

- Community Support: A vast library of over 10 million shared scripts and trading ideas.

- Mobile Access: A top-rated mobile app with a 4.9 average rating from more than 1.5 million reviews.

Crypto and Day Trading

Both platforms offer tools tailored to crypto and day traders. MotiveWave connects with major crypto exchanges like Binance, Coinbase, and Kraken. It also includes automated trading systems and a replay mode for testing strategies.

TradingView supports cryptocurrency traders with features such as:

- Market Analysis: Tools like the Relative Crypto Dominance Polar Chart and live candle visualizations.

- Community Network: A hub where crypto traders share strategies and market insights.

Both platforms run smoothly on Windows, macOS, and Linux operating systems, ensuring dependable performance for active traders.

MotiveWave & TradingView Setup

Final Recommendation

Choosing the right platform depends on your trading goals, technical requirements, and budget. The breakdown of features, pricing, and user feedback above highlights the strengths of each option.

Choose MotiveWave if you:

- Need advanced tools for technical analysis

- Work with Elliott Wave, Hurst Cycles, or Gann Analysis

- Create complex automated trading strategies

- Are ready to invest in professional-level software

Choose TradingView if you:

- Are new to trading

- Appreciate social features and community interaction

- Have a tighter budget

- Prefer mobile-friendly trading options

Here’s a quick comparison to help you decide:

| Platform | Best Suited For | Key Feature |

|---|---|---|

| MotiveWave | Professional Traders | Advanced analysis with over 300 studies/tools |

| TradingView | Beginner to Intermediate Traders | Access to a community of 100M+ traders |

"Pure and simple - MotiveWave is a game changer. For today's advanced technical trader looking to analyze and interpret massive amounts of market data, look no further than the industry leader"

Try MotiveWave’s tools firsthand to see if its features match your trading style. Think about your long-term goals and what you need in a platform before making your decision.