Looking for investment insights? Here's a quick comparison of free and premium investment newsletters to help you decide which fits your goals.

-

Free Newsletters: Great for beginners or quick updates. Examples include:

- Market Bullets: Straight-to-the-point market headlines in under 2 minutes.

- Robinhood Snacks: Fun, conversational updates on market trends and business news.

- The Average Joe: Beginner-friendly, humor-filled market insights.

-

Premium Newsletters: Ideal for detailed analysis and long-term strategies. Examples include:

- Motley Fool Stock Advisor ($199/year): Proven stock picks with +942% returns vs. S&P 500's +178%.

- Seeking Alpha Premium ($239/year): Advanced tools like Quant Ratings and portfolio tracking.

- Morningstar Premium ($199/year): In-depth mutual funds, stocks, and bonds analysis.

- Alpha Picks ($499/year): Focused on value investing with strong returns.

Quick Comparison Table

| Newsletter Type | Examples | Cost | Best For | Key Features |

|---|---|---|---|---|

| Free | Market Bullets, Robinhood Snacks, The Average Joe | Free | Beginners, quick updates | Basic market news, simple insights |

| Premium | Motley Fool, Seeking Alpha, Morningstar, Alpha Picks | $99–$499/year | Long-term or active investors | Detailed analysis, stock tools |

Tip: Start with free newsletters if you're new, and upgrade to premium services as your portfolio grows and you need deeper insights.

I Spent $100,000 On Investment Newsletters (Here’s What I ...

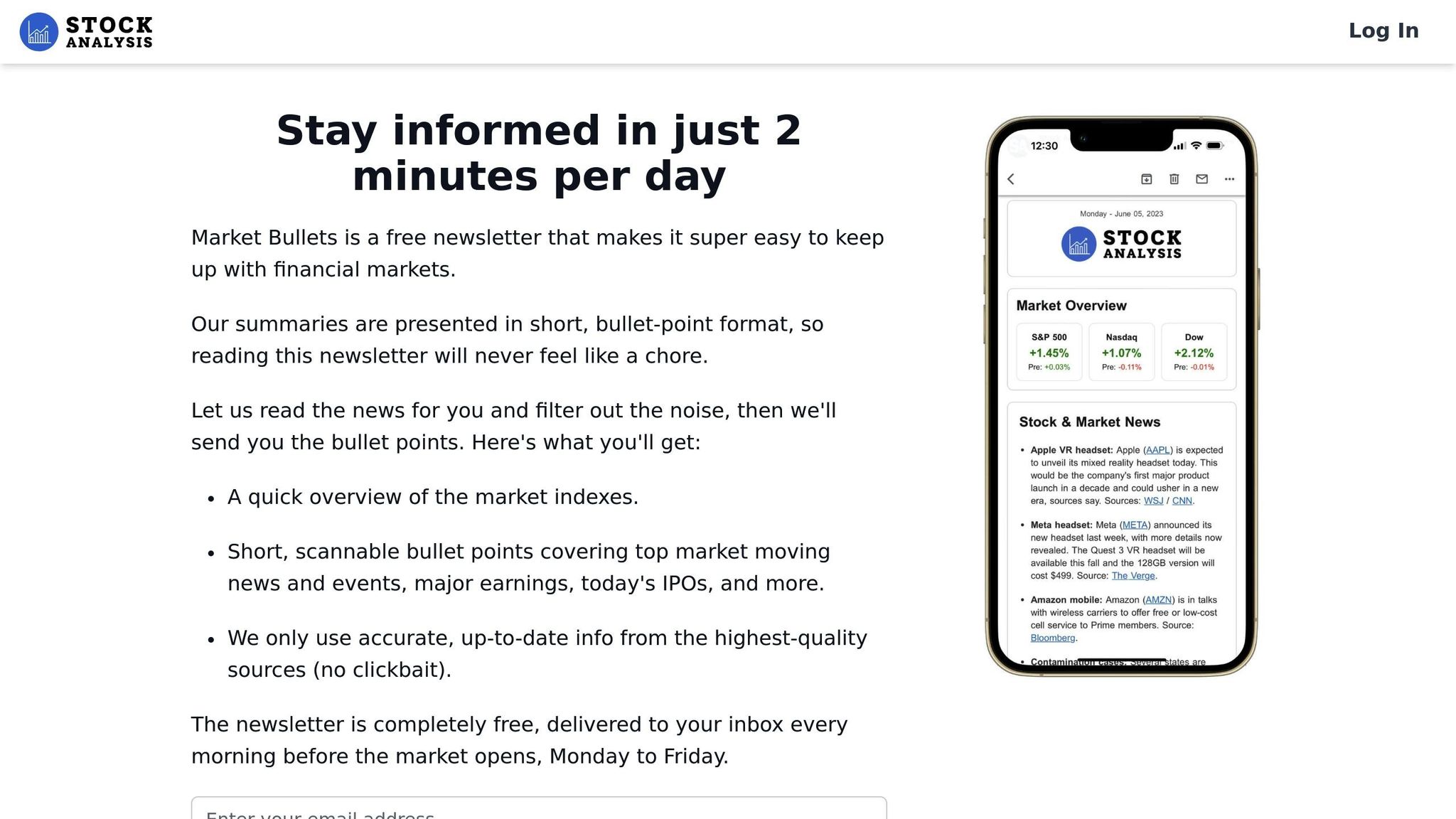

1. Market Bullets

Market Bullets is a free stock market newsletter designed for busy investors who want quick, no-frills updates. Instead of long-winded commentary, it delivers market news in a straightforward bullet-point format.

In less than 2 minutes, readers get the latest market-moving headlines and economic updates. This makes it ideal for professionals who need timely information without sifting through detailed analysis or opinions.

What sets Market Bullets apart is its strict focus on facts. Unlike newsletters that dive into educational content or in-depth insights, it prioritizes delivering concise updates. While it doesn't provide deeper analysis, its strength lies in its ability to deliver key information quickly and efficiently.

Here’s a quick overview of Market Bullets:

| Feature | Description |

|---|---|

| Format | Bullet points |

| Reading Time | Less than 2 minutes |

| Content Style | Fact-only updates |

| Focus Areas | Market headlines |

| Cost | Free |

| Analysis Depth | Surface-level updates |

This newsletter is particularly useful for active traders who value fast, factual updates. It works well as a supplement to more detailed investment tools or resources.

Next, we’ll take a closer look at Robinhood Snacks to compare how it delivers market updates.

2. Robinhood Snacks

Robinhood Snacks breaks down financial news into free, daily updates that are easy to understand and engaging. Similar to Market Bullets, it delivers quick insights but with a distinct approach.

The newsletter's format stands out thanks to these features:

| Feature | Description |

|---|---|

| Format | Conversational and context-driven |

| Content Style | Short, engaging, and to the point |

| Focus Areas | Market trends, company earnings, economic events |

| Cost | Free |

Its storytelling style adds a unique touch. For instance, in January 2023, it highlighted a 10% boost in U.S. same-store sales at McDonald's during the McRib farewell tour, with international sales climbing about 13% in the UK, France, and Germany.

The newsletter also includes specialized sections:

- Snack Facts – Delves into topics like finance, race, and economic patterns.

- What else we're Snackin' – Features a variety of business and economic updates.

"Generally, you will see us focus on efficiency... not just growth at all costs." – Daniel Ek, CEO of Spotify

Robinhood Snacks doesn’t shy away from major market stories. In February 2023, it covered Shein's ambitious goal to double its annual sales to nearly $60 billion by 2025. The piece also noted analysts' concerns, suggesting that Shein might need more repeat customers and higher-priced items to meet its target.

Created by Sherwood Media, LLC, a subsidiary of Robinhood Markets, Inc., the newsletter operates with editorial independence. This ensures its content doesn’t necessarily reflect the views of other Robinhood affiliates.

3. The Average Joe

The Average Joe has carved out a niche in the world of free newsletters by making financial news easy to understand for beginners. Since its start in 2020, it has attracted over 250,000 subscribers. By blending market updates with humor, it simplifies financial topics for those just starting out.

What makes The Average Joe unique:

| Feature | Details |

|---|---|

| Frequency | 4 times per week |

| Reading Time | 5 minutes per issue |

| Target Audience | Beginner investors |

| Content Mix | Market trends, news, education, insights |

| Style | Informative with a touch of humor |

Each issue is packed with memes, quick jokes, and clear market analysis, making complex financial ideas easier to grasp. Its short, engaging format makes it a go-to resource for new investors looking for quick and simple insights.

sbb-itb-2e26d5a

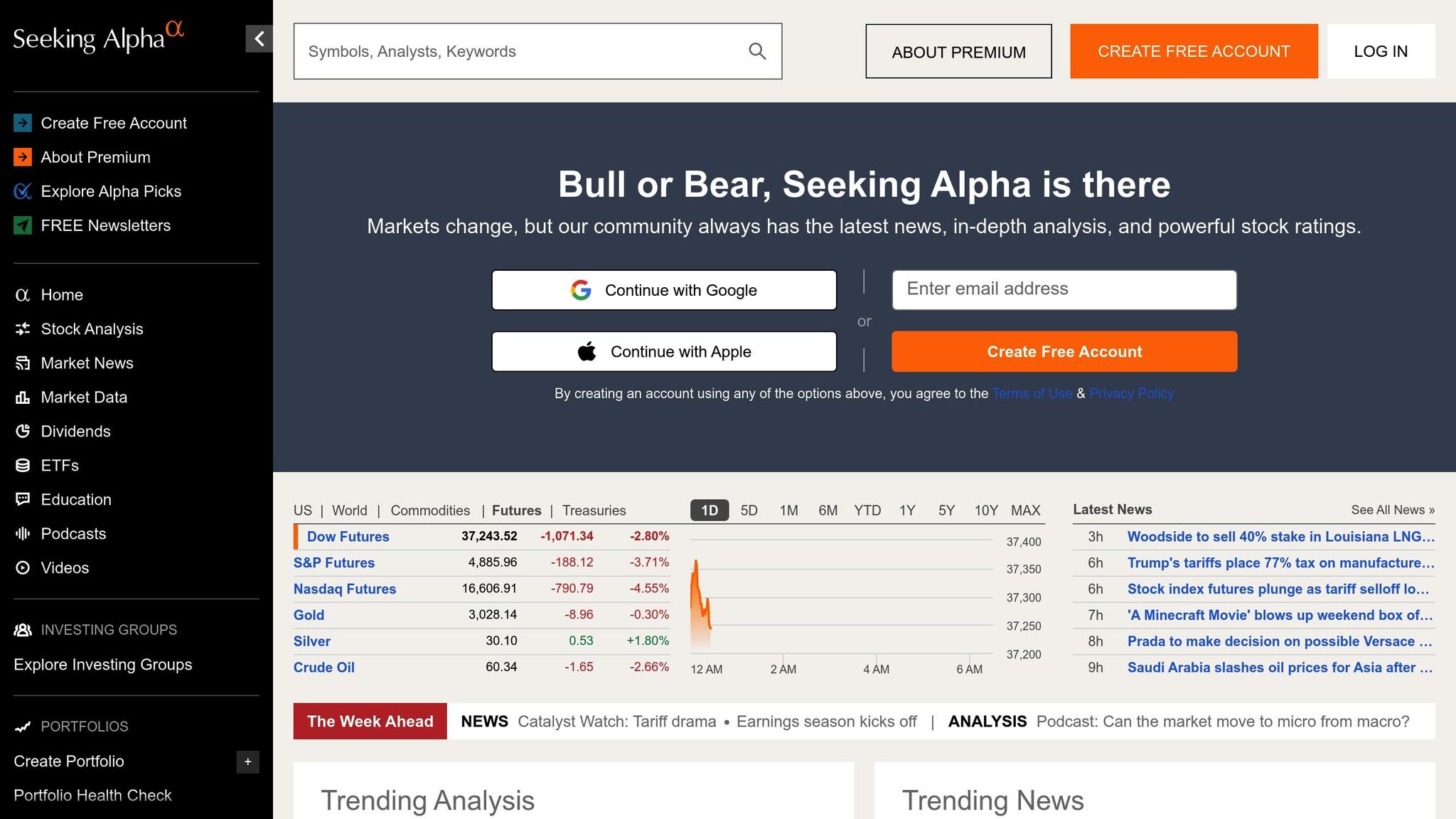

4. Seeking Alpha Premium

Seeking Alpha Premium shifts the focus from quick updates to detailed market research, offering tools and insights tailored for serious investors. Unlike free newsletters, this service provides deep analytical frameworks to help users make informed investment decisions.

| Feature Category | Premium Benefits |

|---|---|

| Research Tools | • Unlimited access to premium articles • Earnings call transcripts • 10‐year financial statements • Advanced stock screener |

| Analysis & Ratings | • Quant Rating system • SA Authors rating • Sell Side rating • Factor grades (Value, Growth, Profitability) |

| Portfolio Features | • Real‐time quant rating alerts • Brokerage account integration • Side‐by‐side comparison (up to 6 stocks) • Portfolio tracking tools |

One standout feature is the Quant Rating system, which outperformed the S&P 500 by 14.95% in 2022. This system evaluates stocks using over 100 metrics within each sector, assigning ratings from "Strong Buy" to "Strong Sell" with scores ranging from 1.0 to 5.0.

Subscribers get access to over 10,000 articles every month, written by more than 7,000 contributors and supported by a community of 250,000+ active investors. These resources include:

- Detailed Stock Analysis: In-depth evaluations using both fundamental and technical data

- Professional Insights: Expert commentary on market trends and opportunities

- Community Engagement: Shared strategies and tips from a large network of investors

"For investors who want curated and data-driven investment insights, Seeking Alpha stands out as a premier financial platform that provides retail investors with invaluable stock analysis, innovative strategies from specialists, quantitative data, and a robust community of like-minded investors."

– Michael Swigunski, MBA

The service costs $4.95 for the first month and $239 annually. On Trustpilot, it holds a 4.0-star rating from over 300 reviews.

5. Morningstar Premium

Morningstar Premium provides in-depth research and analysis tools for mutual funds, stocks, bonds, and index funds. Founded in 1984 by Joe Mansueto, Morningstar has become a respected name in investment analysis.

What sets this service apart is its proprietary rating system. Funds are evaluated based on performance, fees, and risks, with only the top 10% earning a coveted five-star rating. This makes it an excellent resource for identifying quality investments.

| Feature Category | Premium Benefits |

|---|---|

| Research Coverage | • Over 12,000 Canadian fund ratings • 1,800+ global stock analyses • Detailed mutual fund insights • Index fund reviews |

| Exclusive Tools | • Portfolio X-Ray for portfolio insights • "Find Similar" investment tool • Advanced screeners for funds |

| Expert Analysis | • Reports from independent analysts • Curated investment picks • Performance tracking • Risk evaluation tools |

The Portfolio X-Ray tool is particularly useful, offering a detailed look into portfolio strengths, asset allocation, sector breakdowns, and potential risks.

Subscription Options

Morningstar Premium offers several pricing plans:

- Monthly: $29.95

- Annual: $199

- Two-Year: $349

- Three-Year: $449

These plans provide access to all research tools and professional insights.

"Morningstar Premium is a subscription investment platform that provides helpful investment knowledge. It's a one-stop shop for stock research for beginners and experts alike." - Donny Gamble

Key Features

- Access to analysis from over 100 independent analysts

- Detailed mutual fund evaluations

- Portfolio management tools

- Investment recommendations from seasoned specialists

Although the basic version offers limited capabilities, upgrading to Premium unlocks the full range of tools and reports. While there may be a slight learning curve, this platform is packed with resources that active investors will find indispensable.

6. Motley Fool Stock Advisor

Motley Fool Stock Advisor, launched in 2002 by David and Tom Gardner, has become a well-known premium stock recommendation service. As of August 29, 2024, its stock picks have achieved an impressive 754% return, outperforming the S&P 500's 163% during the same period.

Key Features

| Feature Category | Details |

|---|---|

| Stock Recommendations | • Two new stock picks each month • "Best Buys Now" stock selections • Sell alerts when needed |

| Research Tools | • In-depth stock analysis reports • Portfolio allocation tools • Investment simulators • Watchlist functionality |

| Educational Resources | • Investment guides and eBooks • Live video discussions • Special reports • Community for investors |

The service focuses on long-term growth, encouraging users to build a portfolio of at least 25 stocks and hold them for five or more years. These features are paired with subscription plans that cater to different budgets.

Subscription Plans

- Annual Plan: $99 for the first year, then $199 annually

- Monthly Plan: $39 per month (non-refundable)

Professional Ratings

"The Motley Fool was founded in 1993 by brothers David and Tom Gardner with the aim to 'make the world smarter, happier and richer.'"

The service has received favorable ratings from multiple sources:

- Business Insider: 4.13/5

- Trustpilot: 3.7/5

- BBB Rating: 3.82/5

How It Works

Stock Advisor's team reviews thousands of stocks each year to find promising investment opportunities. While it doesn’t offer trading capabilities, the service provides detailed research and recommendations that users can act on through their own brokerage accounts. It was also recognized as the Best Stock Newsletter of 2023.

Benefits and Limitations

Premium and free newsletters each come with their own set of pros and cons. Here's a closer look at how they compare, based on our newsletter reviews.

Service Comparison

| Feature | Premium Newsletters | Free Newsletters |

|---|---|---|

| Research Depth | • In-depth stock analysis • Broad investment insights • Detailed performance tracking |

• Basic market summaries • Limited analysis • Shallow research |

| Tools & Resources | • Portfolio management tools • Stock screening features • Dividend grading systems |

• General market news • Basic investment tips • Few analytical tools |

| Performance Tracking | • Comprehensive historical returns • Benchmark comparisons • Advanced portfolio analytics |

• Simple market stats • Minimal historical data • No personalized tracking |

| Update Frequency | • Real-time updates • Instant trade alerts • Time-sensitive recommendations |

• Delayed data • Periodic updates • General market news |

| Cost Range | $99–$499 annually | Free |

Performance Metrics

Some premium services have delivered impressive results. For example, Alpha Picks achieved returns of +125.60% compared to the S&P 500's +48.19%. Similarly, Motley Fool Stock Advisor recorded +812.33% returns versus +162.59% for the S&P 500.

However, performance isn’t the only factor to consider. It’s also about the overall value of the service.

Value Considerations

- Detailed Insights: Stock recommendations backed by thorough analysis.

- Expert Research: Access to professional evaluations and proprietary ratings.

- Customization: Tools like personalized dashboards and portfolio tracking.

"The investor's chief problem and even his worst enemy is likely to be himself." - Benjamin Graham

Key Limitations

Premium Services:

- Require an annual commitment, ranging from $99 to $499.

- Success depends on consistently following the provided recommendations.

- May not align with every investor's risk tolerance or style.

Free Services:

- Limited research and analysis.

- Possible conflicts due to advertising-driven content.

- Lack of premium features or personalized tools.

Carefully weigh these points to determine which type of newsletter fits your investment goals and preferences.

Making Your Choice

Choose the newsletter that aligns with your investment style and goals based on the analysis below.

For Beginners

If you're just starting out, free newsletters can provide basic market updates and insights. As you gain experience, you might consider a paid service like Motley Fool Stock Advisor, which is designed with beginners in mind.

For Active Investors

If you're an active investor looking for detailed analysis, premium newsletters might be a better fit. Here's a quick comparison of services based on investment styles:

| Investment Style | Recommended Service | Annual Cost | Best For |

|---|---|---|---|

| Value Investing | Alpha Picks | $449 | In-depth company analysis |

| Growth Focus | Motley Fool Stock Advisor | $99 | Long-term stock picks |

| Data-Driven | Morningstar Premium | $199 | Comprehensive research |

| Mixed Strategy | Seeking Alpha Premium | $189 | Multi-analyst insights |

Take a moment to assess your financial resources and match them to your preferred investment style.

Budget Considerations

While premium newsletters come with a higher price tag, they often include detailed research, expert analysis, and tools that could improve your investment decisions. Weigh the subscription cost against the value they bring to your strategy.

Decision Factors

Here’s a quick guide to help you decide:

-

Opt for Premium services if you:

- Already have an established portfolio

- Need targeted stock recommendations

- Want real-time trade alerts

- Rely on professional-grade research tools

-

Stick with Free options if you:

- Are still learning the basics of investing

- Prefer simple market updates

- Have limited funds to invest

- Want to explore different strategies without a commitment